are nursing home expenses tax deductible in canada

This form allows the taxpayer to itemize deductions and this is where you will list your nursing home expenses as a medical expense. Yes in certain instances nursing home expenses are deductible medical expenses.

Are Nursing Home Expenses Tax Deductible In Canada Ictsd Org

A patient can deduct the amount in excess of 75 percent of their adjusted gross income.

. Salaries and wages for attendant care given in Canada. Nursing home costs are tax deductible if the primary reason for residence in a nursing home is to receive medical care. METC claims depend on several factors including the kind of facility you reside in.

Nursing homes special rules apply to this type of facility see the chart. For greater records on what credit and deductions are to be had see the Canada Revenue Agencys courses on medical expenses and Disability-Related Information Review this CRA to look out for unusual tax benefits deductions and credits available to seniors. It is non-refundable but may be subtracted from the taxes you owe.

If that individual is in a home primarily for non-medical reasons then only the cost of the actual. You can claim the disability amount and up to 10000 for these expenses 20000 if. Which nursing home costs are tax deductible.

You can claim the disability amount and up to 10000 for these expenses 20000 if. If the primary reason for entering the nursing home is not to obtain medical care only the portion of the fees directly spent on medical treatment are deductible. Nursing home expenses may qualify for a tax deduction in certain circumstances.

You may be able to claim a METC if your medical expenses exceeded 2397 or 3 of your net income whichever is less. Nursing homes full-time care schools institutions or other places providing care or care and training. If you your spouse or your dependent is in a nursing home primarily for medical care then the entire nursing home cost including meals and lodging is deductible as a medical expense.

The facility should send you a statement detailing which expenses are nursing. Retirement homes homes for seniors or other institutions that typically provide part-time attendant care. This can include the part of the nursing home fees paid for full-time care that relate only to salaries and wages.

However to effectively claim medical expenses the person for whom they are paid is expected to qualify as a dependent on your income tax return but note that this requirement can vary for dependents. Can I deduct these expenses on my tax return. Costs for memory care assisted living and other arrangements are only partly deductible to the extent that they cover actual nursing services.

Fees paid for full-time care in a nursing home. Yes in certain instances nursing home expenses are deductible medical expenses. Only the portion of your monthly bill used to pay attendant care salaries can be deducted.

Nursing and retirement home expenses are considered medical expenses by. 4 Common Tax Deductions for Nurses Mid-wives and other Healthcare Professional. If you your spouse or your dependent is in a nursing home primarily for medical care then the entire nursing home cost including meals and lodging is deductible as a medical expense.

Certain home care services youve paid for yourself your spouse or another dependent can qualify as a deductible expense on your taxes. You also need a completed Form T2201 from a. The federal and Ontario governments have tax credits available to taxpayers including those paid for medical expenses.

Type of expense Certification required Can you claim the disability amount. The size of your METC will depend on your eligible expenses your net income for the tax year and the province in which you live. However you cannot claim both so it is important to determine which claim provides the greatest tax benefit.

Are nursing home expenses tax deductible in canada. Salaries and wages for attendant care given in Canada. For a nursing home patient to receive the tax advantages of being in a nursing home he or she will need to complete a Form 1040.

Robert qualifies as a chronically ill individual because he is unable to perform at least two ADLs. A tax credit will be given to you for taking care of your parents. You need to include a detailed statement of the nursing home costs.

Yes in certain instances nursing home expenses are deductible medical expenses. Your work outfit has to be specific to the work you do as a Healthcare Professional Pharmacist or Nurse. Attendant care costs including those paid to a nursing home can be used as medical expense deductions on your tax return.

Group homes in Canada. Generally you can claim the entire amount you paid for care at any of the following facilities. If you your spouse or your dependent is in a nursing home primarily for medical care then the entire nursing home cost including meals and lodging is deductible as a medical expense.

Expenses for an actual nursing home where someone goes mainly for nursing and other medical care are deductible medical expenses. Eligibility for the disability tax credit may be a requirement to claim fees for salaries and wages as medical expenses. The entire 75000 paid to the nursing home is deductible on Roberts 2019 individual tax return as a medical expense subject to the AGI limitation because it is for qualified long-term care services.

In the case of people living in nursing homes mainly to receive medical care which include their meals and accommodations including their travel costs the cost of nursing homes is generally deductible as part of their medical expenses. Form T2201 or a medical practitioner must certify in writing that the individual is and in the foreseeable future will continue to be dependent on others for his or her personal needs and care because of a. The Canada Revenue Agency CRA has commented that all regular fees paid to a nursing home including food accommodation nursing care administration maintenance and social programming can qualify as eligible medical expenses.

This can include the part of the nursing home fees paid for full-time care that relate only to salaries and wages. For example scrubs lab coats or medical shoes are items you can write off when doing your taxes. The Medical Expense Tax Credit METC can be claimed for costs associated with nursing and retirement homes that are paid by you or your spouse.

To claim these expenses. Typically you can deduct nursing home expenses for yourself your dependents or your spouse. Should he receive medical care while residing in the home you can claim those costs as a deductible expense along with any nursing services that might be provided.

CRAs guide RC4065 Medical Expenses. To qualify for this tax break expenses need to be itemized and youre only allowed to deduct the amount of expenses that exceeds your adjusted gross income AGI by 75.

The Top 9 Tax Deductions For Individuals In Canada

Is Health Insurance A Taxable Benefit In Canada Explained Groupenroll Ca

Are Nursing Home Fees Tax Deductible In Canada Ictsd Org

Are Nursing Home Costs Tax Deductible In Canada Ictsd Org

Medical Expenses Often Overlooked As Tax Deductions Cbc News

How Can I Reduce My Taxes In Canada

Are Assisted Living Expenses Tax Deductible In Canada Ictsd Org

Claiming Your Dependant S Medical Expenses H R Block Canada

Are Nursing Home Costs Tax Deductible Canada Ictsd Org

Health Spending Account Hsa Coverage List Of Eligible Expenses Groupenroll Ca

Tax Deductible Medical Expenses In Canada Groupenroll Ca

Canada S Medical Expense Tax Credit A Comprehensive Guide Groupenroll Ca

Can You Claim Nursing Home Expenses On Taxes In Canada Ictsd Org

Tax Tip Can I Claim Nursing Home Expenses As A Medical Expense 2022 Turbotax Canada Tips

Is Nursing Home Care Tax Deductible In Canada Ictsd Org

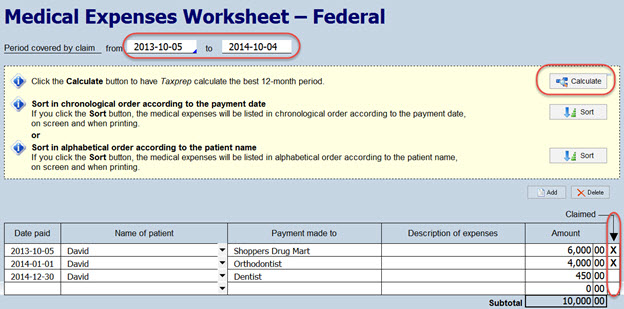

How To Deduct Your Medical Expenses 2022 Turbotax Canada Tips

What Medical Expenses Are Tax Deductible In Canada Cubetoronto Com